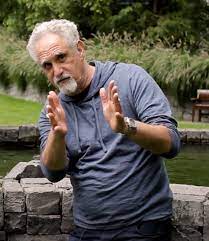

Ready to become a top producing real estate agent? Today on the show we have Roy Cleeves, a Canadian real estate agent generating 20% of his business in a lucrative niche: rent-to-own.

The great thing about real estate is that you can use it in a dozen different ways. As long as the seller and the buyer are happy with the price, the terms of the transaction can be as creative as you want it to be. One of those very creative ways to sell a home today is the rent-to-own model, where an investor will purchase a home and rent it out to someone for a fixed period of time, and it is then bought outright by the renter. Roy helps us explain the benefits of rent-to-own and why its a lucrative niche for a real estate agent.

Rent-To-Own: What You Need To Know

- Find The Tenant First: Because investors will only make the effort to buy a home that will provide cash flow, its important that you find the tenant first. Some ways to find tenants are by advertising in magazines, online and on other listings that you currently have. Once you find the tenant, it is your job to make sure their credit is in good standing and they can afford the rental payments.

- Find The Right Home: Because the investor will pay for the home outright, you need to make sure you find him/her the right deal. Find a home that is not overvalued and will appreciate year after year. Roy and his team work to get their investors a 20% return at the end of the rent term.

- Who To Target: Rent-to-own is perfect for first time homebuyers like millennials or people who aren’t eligible for a mortgage. Additionally, depending on your market, this is a great option if mortgage regulation is strict. Currently, lending is tight in Canada and it takes a big down payment and outstanding credit to get approved.

Things to look out for:

- Market Shifts: Since you outlined the appreciation on the home per year (say 5% per year) with the renter at the beginning of the rental term, the price may change if the market shifts. If the market increases and the home appreciates above the agreed price (say 6%), the renter will usually be safe and only pay the agreed upon price. However, if the price of the home depreciates (only increased 4%), the renter will still make the same amount of monthly payments for the house, but receives the home at a price that is adjusted to the market (ie. pays lower than contract price).

- Renter Buys The House Early: Sometimes, the renter will manage to qualify for a mortgage before the contract end date and decide to purchase the home early. In this case, Roy and his investor simply prorate it and sell it at the adjusted price. For example, if the renter was going to own it for 4 years and agreed to pay a 20% appreciation on the price (or 5%/year) but decides to buy it in 3 years instead, he or she will only have to pay 15% appreciation on the price.

Win-Win

Overall rent-to-own is a win-win situation for the renter and the investor. The renter gets to use his rental payments for a down payment on the home, and the investor receives a great return on investment. In addition, Roy and his investors charge an option premium on top of the rental payments in order to help the owner save for their mortgage down payment. This is beneficial for the investor when buying a second property because the bank can see the property is able to carry itself.

Overall, rent-to-own only makes up for 20% of Roy’s business. The remainder is made up of repeat and referral business. To succeed with both, Roy has the following tips:

- Don’t Be Afraid To Ask: Agents sometimes get afraid to ask for referrals after a closing a deal, but if you do a great job, you will find that people will happily refer friends and family your way.

- Stay In Touch: In order to stay relevant and receive referrals and repeat business, you have to stay in touch with your past clients.

- Hustle: Your success in real estate is directly proportionate to the amount of time you put into your business. Work hard and reap the rewards.

How To Buy Your First Investment

Roy got into real estate because he was an investor. Today, he uses rent-to-own on his own properties. If you want to get into investing, here are some tips:

- Get The Deal First: Most people worry about finding the money to finance the deal first, but this is the wrong way to go about it. Think about it: why would a partner or bank give you money to purchase something you don’t have? Find the property first and then talk to people. You will find this is an easier process.

- Start Small: With your first deal, start by working with a partner who has done it before. Once you get comfortable, you can start to venture out on your own.

- Have An Exit Strategy: This is the most important part of investing. Make sure you know how you are going to get your money back from the deal. This will help you when it comes time to remortgaging and give any partners a clear understanding of the investment objective.

Books For Agents

The Millionaire Real Estate Agent by Gary Keller

Think And Grow Rich by Napoleon Hill

Get these books for free with our Audible free trial! Use www.audibletrial.com/superagentslive for a free copy

Get In Touch With Roy

E-mail him at roycleeves@gmail.com

Join The Conversation On Twitter

Tell us what you thought of this weeks episode using #unpackthatidea!

Our Sponsors

Discover Publications will create a customized, branded 12 page newspaper you can send out to your farm and sphere.

Join The Membership Site

The membership site is finally open! Join the Silver Level to free access to never before seen content. Keep an eye out for Gold and Platinum Level access coming soon!